Thefts have gone beyond stealing of goods or money, one of the most serious thefts these days is Identity Theft.

What Is Identity Theft?

Identity Theft simply means someone uses your identity, your identity document, credit card, SSN, or any other identity related document in a malicious way without your permission and consent. It may include someone stealing your credit card information and using it to purchase stuff or make payments. Someone stealing money from you by accessing your bank account. It also includes crimes like misuse of your SSN for filing of insurance claims and mortgages or taking loans fraudulently using your identity!

How Serious Is Identity Theft?

It maybe much more serious than someone stealing money or goods. Someone can put a bad dent in your credit rating or credit score by using your SSN or identity to take up a loan or a mortgage or maybe making a big transaction of your credit card which you might not be able to settle with the bank.

How Do I Know My Identity Has Been Stolen?

Always check your bank account and credit card statements at least once in a month. Its even better to set a text or email alert for your credit card or bank transactions so that you are aware of the transactions. Also keep a tab on your insurance and credit score at least once every year to check for any discrepancies. If you see something fishy or you don’t know about, check with your bank or insurance company for details.

What Do I Do If I Am A Victim Of Identity Theft?

As soon as you get to see anything fishy, report it to your bank or financial agency involved. For example, if you see a mysteries transaction on your credit or debit card, call your bank, report the misuse and get the card blocked immediately. For any insurance of mortgagee or loan related discrepancy, contact your insurance or loan agency and report the problem. As soon as you report the problem, the liabilities on you because of the damage get greatly reduced. Just like any other theft, this is also a serious crime and agencies involved do their work to bring down such criminals.

Also make a report to Police authorities about it and you can take some additional actions by visiting this page on Federal Trade Commission website related to identity theft.

15 Tips To Prevent Identity Theft

Use Strong Passwords

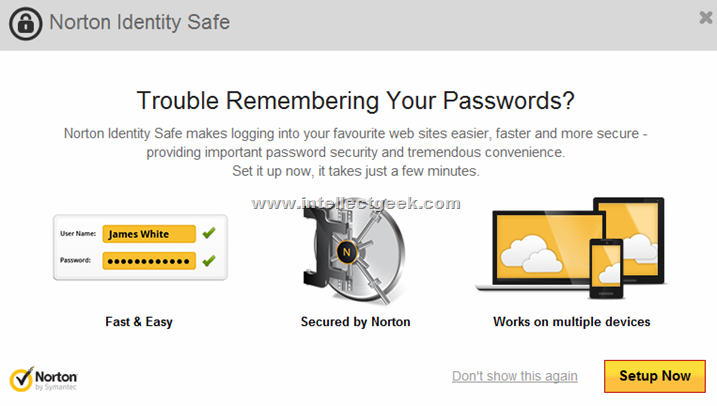

Most identity thefts originate online when someone breaks into your bank or email account and get access to your sensitive identity information. So always use strong passwords which are not easy to guess.

Use Difficult Card PIN Numbers

Most people set their birthdate as their credit card or debit card PIN. For most identity thief, such weak pins are a piece of cake. If you loose your wallet which has your ATM card with your driving license with your date of birth on it, you are looted.

Use Good Antivirus Software

Keep good security software on your computer so that there is no intrusion of leakage of your financial or identity information from your computer. You can refer to our guide here- Paid VS Free Antivirus- Which Should I Use?

Be Careful About Phishing Attacks

Don’t fall for the trick emails or letters which say that you have won a million dollars from some giant company or in some lottery. Such schemes lure you to give in your sensitive information which leaves you in big mess.

Reset Your Computers and Phones Before Selling

Never sell your phones or tablets or computer before you set them to factory setting or remove all the data from them. If you don’t do the same, you are probably just giving away your identity information along with it.

Be Careful When Logging Into Websites

Whenever you login to any website, make sure that it is protected by https which usually shows a lock symbol on top of your internet browser. Loosing a password to a fake website which looks just like real is not rare. Also never click on any login links in the emails you get from strangers (or even friends), its better to type the address carefully for bank and email websites.

Be Careful When Shopping Online

Online shopping can also make you loose your credit card information in case the payment page is not properly secure or legitimate. Be extra careful whenever making a financial transaction online.

Be Careful At ATMs

Person standing behind you at the ATM maybe watching you type your ATM PIN. Be careful about such persons and enter your PIN when no one’s looking at it, or just hide it with the other hand.

Don’t Carry Sensitive Identity Documents In Wallet

Its better not to carry sensitive documents like an SSN card which can be misused if lost. Keep them safe at a place which is not prone to be accessed by someone else.

Take Good Care Of Your Wallet / Purse / Bag

Always be careful about your wallet, especially in public places when its crowded.

Be Careful When Discarding With Financial Documents / Statements

Do you throw away old bank or credit card statements in garbage? What if someone sneaks into your backyard and gets it from your garbage and rip you off. So its recommended that you shred or at least tear off these documents and discard them properly.

Be Careful About Your Mails

Snail mails as we call them, may contains sensitive information, like bank statements, driving license form, loan documents, tax documents etc. So be careful with handling your mail and ensure that its not dropping into the hands on any stranger.

Set Text Email Alerts On Credit Card / Debit Card Transactions

Most banks offer text or SMS alerts on bank and credit card transactions. You can opt for the same and keep a tab on when its being charged to be sure that its not being misused.

Keep Special Care of SSN Card and Check Books

SSN and Check books are something which must be kept in good security and should not be revealed to anyone without the need of it.

Don’t Disclose Sensitive Information On Phone

Don’t give away your SSN or bank details to any tele-caller or someone who claims to be from your bank, because bank guys usually don’t ask for such information. It maybe someone pretending that they are form you bank etc.

Bonus Tip

Try to keep few (only as much needed) number of credit cards or banking accounts. Reducing your financial points of vulnerability helps reduce the leaks greatly. We hope you found this article useful, if yes, please like us on Facebook here.